Debt held by the public and total debt are two different concepts

a. True

b. False

A

You might also like to view...

When a good is nonrivalrous in consumption, then: a. consumption by an additional individual will significantly reduce the benefits derived by others from a public good. b. individuals who refuse to pay for a public good cannot be excluded from benefiting from it

c. consumption by an additional individual does not prevent others from benefiting from a public good. d. individuals who refuse to pay for a public good can be excluded from benefiting from it.

A market transaction causes an externality if someone

a. directly involved in the transaction receives uncompensated benefits or costs from it. b. not directly involved in the transaction receives uncompensated benefits or costs from it. c. directly involved in the transaction seeks legal assistance to ensure that the transaction is carried out. d. not directly involved in the transaction interferes in it by imposing regulations or product standards.

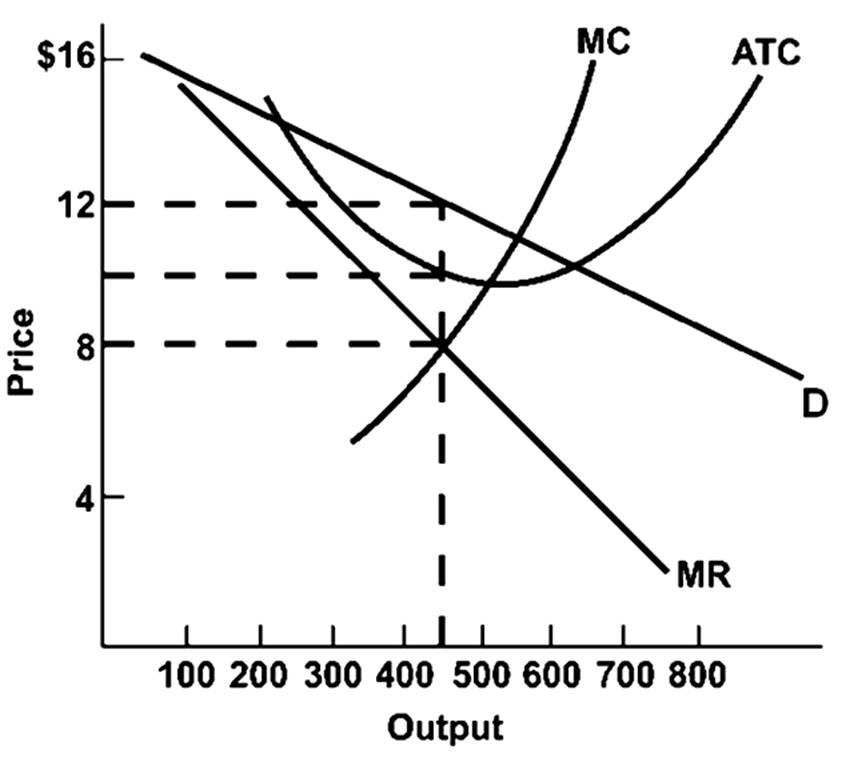

The profit-maximizing firm's output will be about

A. 450.

B. 500.

C. 550.

D. 625.

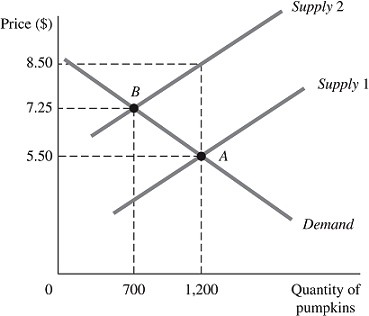

Refer to the information provided in Figure 5.7 below to answer the question(s) that follow.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Using the midpoint formula, the price elasticity of demand for pumpkins from the equilibrium point before the imposition of the tax to the equilibrium point after the imposition of the tax is

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Using the midpoint formula, the price elasticity of demand for pumpkins from the equilibrium point before the imposition of the tax to the equilibrium point after the imposition of the tax is

A. -0.02. B. -0.47. C. -2.11 D. -4.43