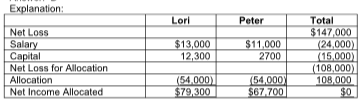

For the year ending December 31, 2019, the partnership reported a net loss of $147,000. What is Peter's share of the net loss?

Nancy and Peter enter into a partnership and decide to share profits and losses as follows:

1. The first allocation is a salary allowance with Nancy receiving $13,000 and Peter receiving $11,000.

2. The second allocation is 15% of the partners' capital balances at year end. On December 31, 2019, the

capital balances for Nancy and Peter are $82,000 and $18,000, respectively.

3. Any remaining profit or loss is allocated equally.

A) $13,700

B) $54,000

C) $5800

D) $67,700

D) $67,700

You might also like to view...

Which of the following statements is true of negotiating an instrument?

A. It must be transferred voluntarily. B. It must be transferred by a person other than the issuer. C. It must not be transferred involuntarily. D. It must be transferred by the issuer.

Explain how marketers use personality in marketing products and services

What will be an ideal response?

The social desirability bias is

A. the desire to be accepted as a foreigner in the local setting, so assuming local dress and mannerisms. B. a bias in favor of those locals who pretend to like and accept the researcher. C. the respondent's desire to please the researcher, leading to answers calculated to please. D. the desire to become part of the social in-group in the new setting, with high status.

Personal networking and referrals are the primary route to hiring in today's digital age

Indicate whether the statement is true or false