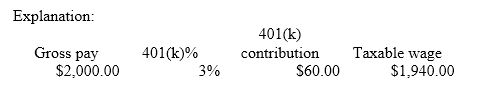

Amity is an employee with a period gross pay of $2,000. She elects to have 3% of her gross pay withheld for her 401(k) contribution. What will be her taxable income be for federal income taxes?

A) $2,000

B) $1,970

C) $1,940

D) $1,910

C) $1,940

You might also like to view...

Matt is frequently nervous, tense, and worried, both at work and at home. He likely scores low on which of the Big Five personality dimensions?

A. self-monitoring B. conscientiousness C. extroversion D. openness to experience E. emotional stability

An employee from Hamid's Automobile Inc. called up Horner's home to repair the latter's car. It was repaired in Horner's garage. When Horner defaulted on the bill, Hamid's employee went to his house to take possession of the car, claiming that the corporation had a lien on the car by virtue of the work performed on it. According to this scenario, which of the following statements is true?

A. The corporation has no lien on the car because the employee did not notify Horner at the time of the repairs that a lien would be claimed. B. The employee is entitled to the possession of the car because he was the one who performed the repairs on the car. C. Hamid's employee is justified in his actions as the corporation did have a lien on the car by virtue of the work performed on it by its employee. D. The corporation has no lien on the car, because its employee came to Horner's house to make the repairs and so Horner never gave up possession of his car to Hamid's.

The FTC blocked the merger of Staples, Inc and Office Depot because they controlled a large percentage of the national market for office supplies

Indicate whether the statement is true or false

Explain any two types of hybrid defenses