The interest rate is the opportunity cost of transferring spending power between time periods. However, the market mechanism may fail to provide adequately for future economic growth. List the reasons why a market might fail.

What will be an ideal response?

Baumol and Blinder list the following three reasons why there may be a failure:1. Government may manipulate the interest rate to achieve various objectives with little regard to the impact on investment for future growth.2. Persons may suffer from “a defective telescopic faculty”—they may not give adequate weight to the future and may wish to consume today instead of invest for tomorrow.3. Some decisions have irreversible consequences, such as destruction of a unique natural habitat. Once “developed,” it is gone forever. It may be unwise to leave these decisions to purely profit-driven motives.

You might also like to view...

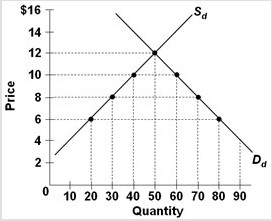

Use the following graph, where Sd and Dd are the domestic supply and demand curves for a product, to answer the next question. The world price of the product is $6. If an import quota of 40 units is imposed on the product, then the equilibrium price would be_____ and the quantity consumed would be ________ units.

The world price of the product is $6. If an import quota of 40 units is imposed on the product, then the equilibrium price would be_____ and the quantity consumed would be ________ units.

A. $6; 80 B. $12; 50 C. $10; 60 D. $8; 70

When the Social Security surplus is used to cover the current operating expenses of the federal government, it will

a. make it easier for future taxpayers to provide promised Social Security benefits to baby boomers. b. reduce the outstanding debt of the federal government. c. make it possible for Congress and the president to spend more without raising current taxes or borrowing from the general public. d. increase the credibility of the Social Security benefits promised to future retirees.

Two bonds have the same term to maturity. The first was issued by a state government and the probability of default is believed to be low. The other was issued by a corporation and the probability of default is believed to be high. Which of the following is correct?

a. Because they have the same term to maturity the interest rates should be the same. b. Because of the differences in tax treatment and credit risk, the state bond should have the higher interest rate. c. Because of the differences in tax treatment and credit risk, the corporate bond should have the higher interest rate. d. It is not possible to say if one bond has a higher interest rate than the other.

If real money demand increases 5% and real money supply increases 10%, by about how much does the price level change?

A. Unchanged B. Rises by 5% C. Rises by 2% D. Falls by 5%