Dividends paid from a foreign subsidiary to the U.S. parent company are not taxable under U.S. law

Indicate whether the statement is true or false

False

You might also like to view...

Which of the following terms best describes "Cost of goods available for sale"?

a. Cost of goods available for sale is an expense account. b. Cost of goods available for sale is added to beginning inventory to determine cost of purchases during the period. c. Cost of goods available for sale is subtracted from net sales to arrive at the gross margin d. Cost of goods available for sale is allocated into cost of goods on hand and cost of goods sold at the end of the fiscal year

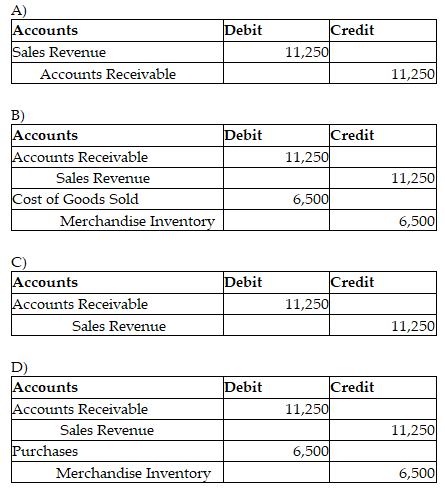

Smithville Furniture sold 15 desks, with a cost of $6,500, for $11,250 on account. Smithville uses the periodic inventory system. Which of the following is the correct way to record this transaction?

Manufacturers' agents are the most common type of agent wholesaler

Indicate whether the statement is true or false

Electronic banking enables cash transactions to occur using retail coding systems

Indicate whether the statement is true or false