State the reasons for the increase in mergers and the criteria for determining the legality of mergers

What will be an ideal response?

An increase in mergers may take place for one or any combination of the following reasons:

a. Undervalued assets: It is cheaper for a company such as GM to buy Electronic Data Systems (EDS) and Hughes Aircraft in order to obtain computer capabilities, a computer transmission network, and telecommunications capabilities than to borrow money and expand internally in those areas. In the opinion of GM and its investment banking advisers, both EDS and Hughes Aircraft were undervalued stocks in the marketplace and, therefore, a "good buy."

b. Diversification: During a recession (e.g., 1981-1983; 2008-2010), when stocks are generally underpriced, companies may seek to diversify—that is, to reduce their risks in one industry's business cycle by investing in another industry. U.S. Steel's acquisition of Marathon Oil Company was an attempt at diversification by a steel company hit hard by recession and foreign imports.

c. Tax credits for research and development: Between the middle of 1981 and the end of 1985, the Internal Revenue Code allowed a 25 percent tax credit for increases in research capabilities acquired through mergers.

d. Economies of scale: A merger often brings about greater efficiency and lower unit costs, particularly in research and development and in manufacturing.

e. The philosophy that "bigness" is not "bad": This flexible approach to mergers was embodied in the Justice Department's Merger Guidelines in the period 2001-2008.

The U.S. Supreme Court, the lower federal courts, the Justice Department, and the Federal Trade

Commission use the following criteria, or steps, to decide on the legality of a merger:

a. Relevant product and geographic markets

b. Probable impact of the merger on competition in the relevant product and geographic markets

You might also like to view...

The effective rate is less than the contract rate when bonds are issued at a discount

Indicate whether the statement is true or false

Investing activities include those transactions involving the purchase and sale of long-term assets, investments in debt and equity securities, and lending money and collecting the principal on the related loans

Indicate whether the statement is true or false

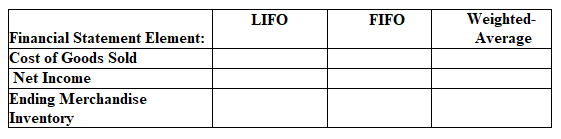

Complete the following table, which compares the effects of LIFO, FIFO and weighted-average inventory costing methods on the financial statements in periods of declining inventory costs. The answer should be lowest, highest, or middle.

Nominal account balances are reduced to zero by closing entries

Indicate whether the statement is true or false