Which of the following is not a feature of an efficient tax?

a. An efficient tax should minimize the excess burden of taxation.

b. An efficient tax should have low compliance costs.

c. An efficient tax should be equitable.

d. An efficient tax should be easy to monitor and administer.

c

You might also like to view...

One way to avoid counting the prices of intermediate goods multiple times in computing the value of GDP is to:

A. sum the value added of only producers of final goods and services. B. sum the value added of producers of both intermediate and final goods and services. C. sum the value added of only producers of intermediate goods and services. D. subtract the value added of producers of intermediate goods and services from the value added of producers of final goods and services.

Economic models are used primarily to

a. predict behavior under specific circumstances b. make an exact reproduction of one facet of the economy c. increase the mathematical complexity and rigor of economics d. provide simple answers to simple questions e. give accurate forecasts of the future

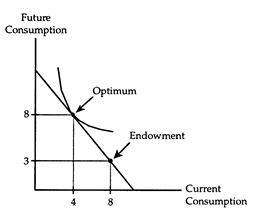

Refer to Current and Future Consumption. The diagram shows the case of a

a. representative agent.

b. net borrower.

c. net lender.

d. disequilibrium situation.

A direct or positive relationship exists between a country's

a. productivity and its standard of living. b. amount of government spending and its productivity. c. total population and its average citizen's income. d. rate of population growth and the extent of its trade with other countries.