A progressive income tax system can be defined as one in which

a. the government uses taxes paid by the wealthy to fund programs for the poor.

b. an individual pays more dollars in taxes when his income rises.

c. the marginal tax rate rises over time.

d. the average tax rate is higher for individuals with higher incomes.

d

You might also like to view...

Refer to the scenario above. After the implementation of the tax, Thomas's expenditure on wine will:

A) remain the same. B) increase by $50. C) decrease by $50. D) increase by $100.

Suppose total factor productivity increases. Which of the following is incorrect?

A) Households are better off. B) Consumption goes up. C) The real wage goes down. D) Output goes up.

The government corrects for externalities in all of the following ways EXCEPT

A) taxes. B) regulation. C) lobbying. D) subsidies.

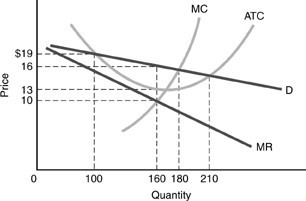

Use the above figure. The profit-maximizing output and price for this monopolistically competitive firm are respectively

Use the above figure. The profit-maximizing output and price for this monopolistically competitive firm are respectively

A. 210 and $15. B. 160 and $16. C. 160 and $13. D. 100 and $19.