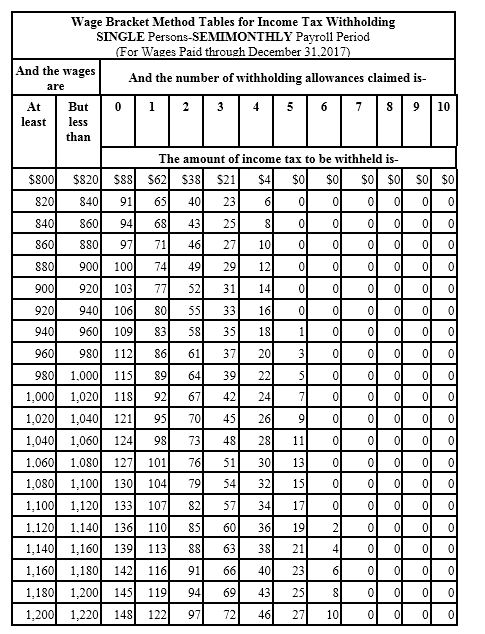

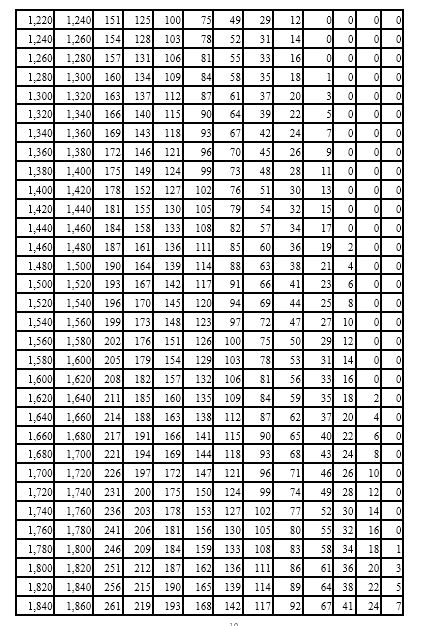

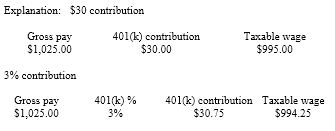

Julio is single with 1 withholding allowance. He earned $1,025.00 during the most recent semimonthly pay period. He needs to decide between contributing 3% and $30 to his 401(k) plan. If he chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table)?

A) $77.00

B) $86.00

C) $92.00

D) Both yield the same tax amount

D) Both yield the same tax amount

You might also like to view...

All of the following are principal provisions of the Sarbanes-Oxley Act of 2002 except:

a. At least one member of the audit committee of the board of directors must be a "financial expert.". b. The lead audit or coordinating partner and the reviewing partner of the public accounting firm must rotate, or change, every five years. c. The firm's chief executive officer and the chief financial officer must issue a statement along with the audit report stating that the financial statements and notes fairly present the operations and financial position of the firm. d. The FASB has oversight and enforcement authority over the SEC.

Money that a bank has available for customer loans would be an example of a(n):

A) value-added product B) expected product C) generic product D) potential product E) customer product

Drop shipping:

A) is equivalent to cross-docking. B) is the opposite of a blanket order. C) means the supplier will ship directly to the end consumer, rather than to the seller. D) is the same thing as keiretsu. E) is a good reason to find a new firm to ship your products.

A ___________ ______________ is a detailed accounting of industry analysis, potential markets, statement of purpose, description of the business, financial data, and other pertinent information necessary for the success of the business.

Fill in the blank(s) with the appropriate word(s).