Describe the U.S. Social Security system and explain how it is funded.

What will be an ideal response?

Originally created as a trust fund system designed to be actuarially sound, the addition of new categories of eligibility and increases in benefits led to the point that the system was taking money from current workers and paying it out to retirees. Reforms in the early 1980s, which increased payroll tax payments into the system and reduced withdrawals, have produced a surplus for the time being. Projections for early next century show the surplus depleted and a deficit in payroll tax collections to meet benefits distribution under the system as currently structured.

You might also like to view...

In long-run equilibrium in perfect competition, every firm is producing at minimum average cost.

Answer the following statement true (T) or false (F)

Lowering tax rates was the main priority of the

A. classicals. B. Keynesians. C. monetarists. D. supply-siders.

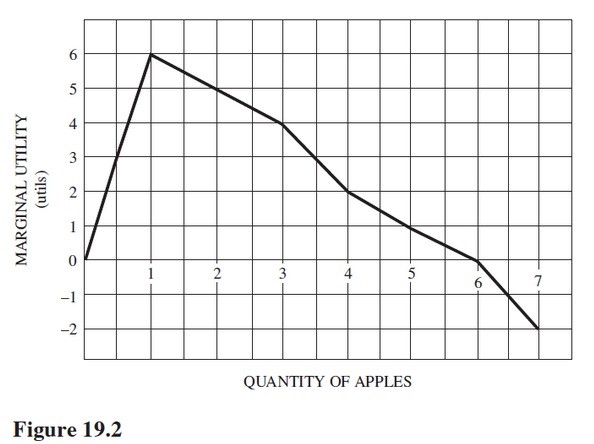

Refer to Figure 19.2. The total utility of five apples is

A. 20 utils. B. 1 utils. C. 17 utils. D. 18 utils.

If you lost 10 percent on $200 worth of stock in a 2x margin account, then you would:

A. lose $20. B. gain $40. C. gain $20. D. lose $40.