Suppose four companies in an industry are considering a merger. Their market shares are: Company A 25%, Company B 16%, Company C 12%, and Company D 40%. Which of the following represents their score using the HHI method?

a. 93

b. 656

c. 1,600

d. 2,625

d. 2,625

The Herfindahl-Hirschman Index (HHI) is calculated by summing the squares of the market share of each firm in the industry. In this case, 25 2 + 16 2 + 12 2 + 40 2 = 625 + 256 + 144 + 1,600 = 2,625.

You might also like to view...

Which of the following is not a common rationale for government involvement in education?

a. Public education produces a positive inframarginal externality. b. Public provisions of education makes students into better citizens. c. Public financing of education is necessary on equity grounds. d. all of the above

Suppose milk and cereal are compliments and the demand for milk is Qdm = 40 - 6Pm - 2Pc, where Qdm stands for millions of gallons of milk demanded, Pm stands for the price of milk and Pc stands for the price of cereal. The supply of milk is Qsm = 6Pm - 8, where Qsm stands for millions of gallons of milk supplied. The demand and supply of cereal are Qdc = 90 - 5Pc - Pm and Qsc = 5Pc - 10, respectively, where Qdc stands for millions of boxes of cereal demanded and Qsc stands for millions of boxes of cereal supplied. Which of the following gives the market-clearing curve for milk?

A. Pm = 4 - (Pc/6) B. Pm = (32/12) - (Pc/6) C. Pm = (32 - 2Pc)/12 D. Pm = (32/12) + (Pc/6)

Profit-maximizing firms enter a competitive market when, for existing firms in that market,

a. total revenue exceeds fixed costs. b. total revenue exceeds total variable costs. c. average total cost exceeds average revenue. d. price exceeds average total cost.

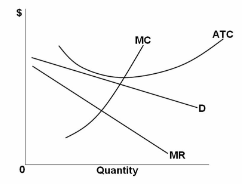

In short-run equilibrium, the monopolistically competitive firm shown will set its price:

A. below ATC.

B. above ATC.

C. below MC.

D. below MR.