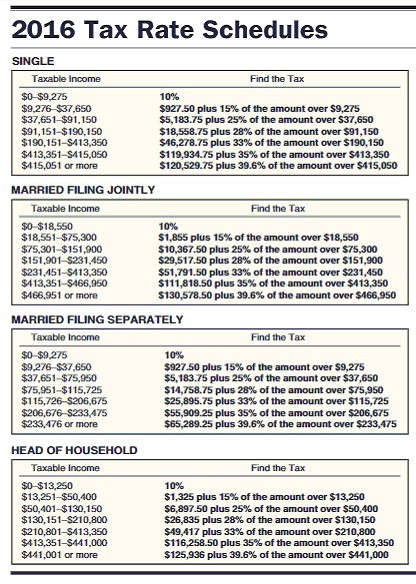

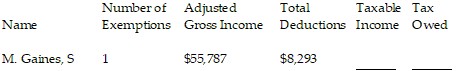

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

A. $43,444; $6,632.25

B. $43,444; $6,144.10

C. $46,287; $7,721.75

D. $47,494; $7,998.50

Answer: A

You might also like to view...

Find the LCD for the list of rational expressions. ,

,

A. t - 2 B. t C. t(t - 2) D. 54

Simplify.(64 - 18) ? [(80 + 10 ÷ 5) - (6 ? 6 - 3 ? 3)]

A. 2494 B. 2530 C. 2587 D. 2630

Determine whether the given function is even, odd, or neither.f(x) = x3 - 4x

A. Neither B. Odd C. Even

Solve the problem.A salesperson has a base salary of $1100 plus a 6% commission on her sales.a) Write a linear equation that gives her salary, y, in terms of her sales, x.b) Using the equation found in part a, find how much the salesperson earns if the sales are $37,000.c) If the earnings are $3980, then how much were the sales?

A. y = 1100 + 0.06x; $3320; 47,000 B. y = 1100 + 0.06x; $3320; 49,000 C. y = 1100 - 0.06x; $3320; 50,000 D. y = 1100 + 0.06x; $3320; 48,000