A lump-sum tax does not produce a deadweight loss

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

The point where the indifference curve is tangent to the budget line

A) is the best affordable point. B) is where the marginal rate of substitution exceeds the relative price by as much as possible. C) is a point on consumer's demand curve. D) All of the above answers are correct.

During the 1970s, demand-management policy: a. continued to be highly successful in curing the economy's economic problems

b. was found to be highly unsuitable in periods of stagflation such as the decade of the 1970s. c. was so unsuccessful that economists advised a return to the pre-World War II philosophy of fiscal policy. d. was unsuccessful because automatic stabilizers no longer influenced the economy. e. was unsuitable because it affected aggregate supply more than aggregate demand.

When a banking system provides people with immediate access to their deposits, but allows banks to loan out part of its reserves, it is known as the

a. excess reserve system b. excess demand deposit system c. fractional reserve system d. legal required reserve system e. multiple banking system

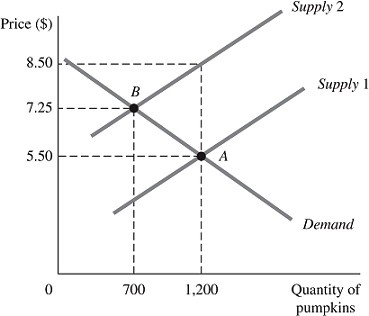

Refer to the information provided in Figure 5.7 below to answer the question(s) that follow.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. The amount customers will pay per pumpkin after the imposition of the tax is

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. The amount customers will pay per pumpkin after the imposition of the tax is

A. $1.75. B. $3.00. C. $4.25. D. $7.25.