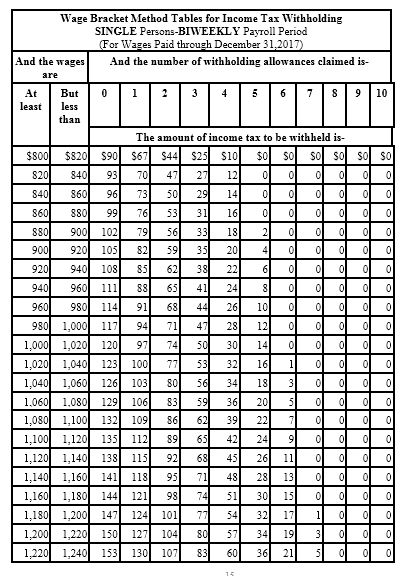

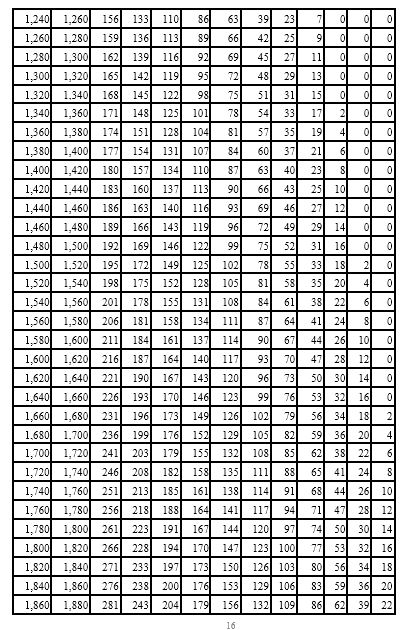

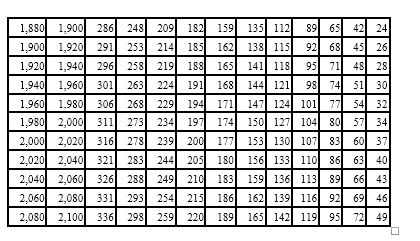

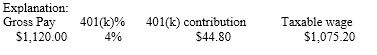

Caroljane earned $1,120 during the most recent pay biweekly pay period. She contributes 4% of her gross pay to her 401(k) plan. She is single and has 1 withholding allowance. Based on the following table, how much Federal income tax should be withheld from her pay?

A) $115.00

B) $109.00

C) $121.00

D) $106.00

D) $106.00

You might also like to view...

The trial balance is

a. a list of revenues showing the title and balance of each account; b. used as an aid in preparing the balance sheet; c. reported to the federal government; d. a formal state or report; e. all of these

Having the discretion and the means to asymmetrically enforce one’s will over others is known as ______.

A. influence B. compassion C. coercion D. power

Horton Company reports the following: Contributed Capital $ 200 Total Revenues $ 800 Total Liabilities $1,200 Beginning Retained Earnings ($ 100) Total Expenses $ 500 Dividends $ 0 What are Total Assets?

a. $2,600 b. $1,600 c. $1,400 d. $1,000 e. $800

Beverage firms sometimes hire attractive young people to sit at fashionable bars, sipping the company's latest product offering. The firms hope these "models" will serve as a(n) ________ and influence consumers.

A. reference group B. cognitive learning experiment C. cultural determinant D. risk avoider E. evoked set