Compound interest factors are provided below:

?

?

5%, n = 10

5%, n = 20

10%, n = 10

10%, n = 20

Future value of a single sum

1.629

2.653

2.594

6.728

Future value of an ordinary annuity

12.578

33.067

15.937

57.275

Present value of a single sum

0.614

0.377

0.386

0.149

Present value of an ordinary annuity

7.722

12.462

6.145

8.514

Present value of an annuity due

8.108

13.085

6.759

9.365

Using the above factors, answer each of the following questions.

a.How much will you have in 10 years if you invest $30,000 in an investment that earns 10% semiannually?b.How much do you have to invest today to have $30,000 in 10 years if the investment earns 10% annually?c.How much will you have in 10 years if you invest $15,000 at the end of each year in an investment earning 10% annually?d.How much do you have to invest today and every six months thereafter for the next 10 years if you want to accumulate a total of $400,000 10 years from today in an investment paying 10% semiannually?

What will be an ideal response?

| a. | Future value, 5%, 20 periods: $30,000´2.653 = $79,590 |

| ? | ? |

| b. | Present value, 10%, 10 periods: $30,000´0.386 = $11,580 |

| ? | ? |

| c. | Future value ordinary annuity, 10%, 10 periods: $15,000´15.937 = $239,055 |

| ? | ? |

| d. | Present value ordinary annuity, 5%, 20 periods: $400,000 ÷ 13.085 = $30,569 |

You might also like to view...

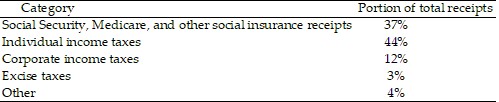

Solve the problem.In a recent year, the total receipts for the US federal government were estimated to be $2288 billion. The total outlays were estimated to be $2613 billion. The table below shows the makeup of federal government receipts that year - the percentage of total receipts coming from each category. Approximate makeup of federal government receipts How much income came from individual income taxes that year?

How much income came from individual income taxes that year?

A. $1.1 trillion B. $1 trillion C. $965 billion D. $847 billion

Use the commutative law of addition to write an equivalent expression.5 + b

A. 5(1 + b) B. b + 5 C. 5b D. b5

Solve the equation for the unknown quantity.t - 3 = 18

A. -21 B. 21 C. -15 D. 15

Balance sheet values are calculated using compound interest (present value) calculations for all of the following except

A. bonds payable. B. long-term notes receivable. C. long-term lease liabilities. D. deferred income taxes.