Eight years ago you purchased an asset for $100,000 that has yielded a nominal capital gain of $30,000. If you sold the asset today, your inflation-adjusted capital gains would be zero due to inflation over the last eight years

The capital gains tax is 28 percent. If you sold the asset today your tax liability would be A) zero.

B) $28,000.

C) $8,400.

D) cannot be determined without more information.

C

You might also like to view...

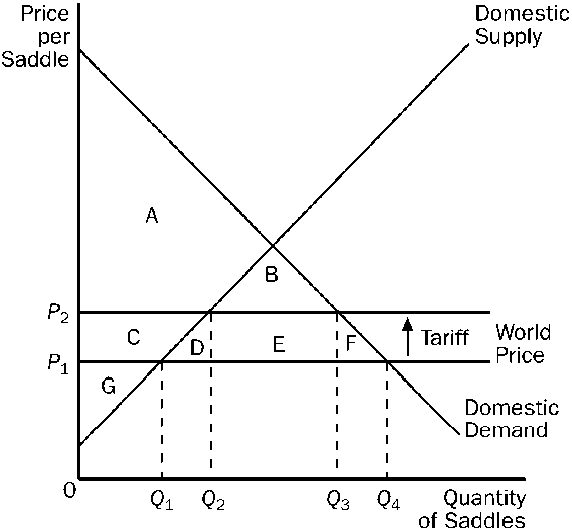

Figure 19-2

A. ABCD. B. CDEF. C. DEF. D. ABCDEF.

"If production of a good creates an external cost, then, when production is such that the marginal private costs are equal to the marginal private benefits, the market outcome will be inefficient

" Explain whether this assertion is correct or incorrect.

Branding:

A. can be a barrier to entry. B. guarantees high-quality products. C. promises the differences in products are completely perceived and not real. D. All of these statements are true.

Figure 17-10

Refer to . Consumer surplus with the tariff is

a.

A.

b.

A + B.

c.

A + C + G.

d.

A + B + C + D +E + F.