Accounts receivable arising from sales to customers amounted to $40,000 and $32,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $110,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is

A) $118,000.

B) $110,000.

C) $102,000.

D) $150,000.

A

You might also like to view...

Which of the following statements regarding the inclusion of liabilities on the statement of cash flows is true?

a. All current liabilities affect the operating activities section. b. Long-term liabilities generally affect the investing activities section. c. A decrease in a current liability from the beginning to the end of the year is accompanied by a decrease of cash. d. A decrease in a current liability from the beginning to the end of the year is accompanied by an inflow of cash.

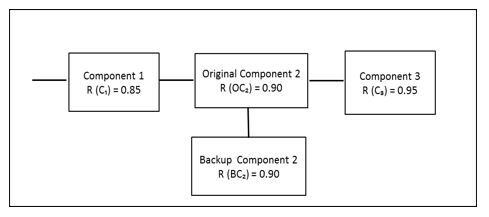

Calculate and indicate the overall reliability of the system shown in the following figure:

A. 0.7994

B. 0.8764

C. 0.7896

D. 0.9874

On April 12, Hong Company agrees to accept a 60-day, 10%, $4,500 note from Indigo Company to extend the due date on an overdue accounts payable. What is the journal entry needed to record the transaction by Indigo Company?

A. Debit Sales $4,500; credit Notes Payable $4,500. B. Debit Accounts Payable $4,500; credit Notes Payable $4,500. C. Debit Cash $4,500; credit Notes Payable $4,500. D. Debit Notes Payable $4,500; credit Accounts Payable $4,500. E. Debit Accounts Receivable $4,500; credit Notes Payable $4,500.

A _________ is an extension of the parent company, not a separate legal entity.

Fill in the blank(s) with the appropriate word(s).