Personal income is equal to

A. national income minus (corporate income taxes and Social Security).

B. NDP minus national income.

C. disposable personal income plus personal income taxes.

D. disposable personal income plus personal and corporate income taxes.

Answer: C

You might also like to view...

Suppose the price elasticity of teenagers' demand for cigarettes is 2.0. If the government imposes a tax on cigarettes that raises the price by 10 percent, by how much will it reduce teenaged smoking?

A) by 5 percent B) by 10 percent C) by 15 percent D) by 20 percent

Environmental regulation by the government

a. leads to ideal outcomes in most cases. b. is often based on goals for pollution levels that were determined by market signals. c. is most appropriate when the pollution of concern comes from many sources. d. is most likely to be economically efficient when the regulation provides substantial benefits for special-interest groups.

Like private borrowers, governments

A. can raise taxes to pay off their debts. B. have to pay interest on their debts. C. regulate the industries through which they borrow. D. do not, in the long run, have to pay back their debts.

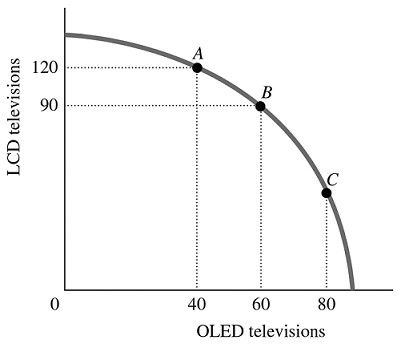

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

A. -2/3. B. -3/4. C. -1.5. D. -20.