In the loanable funds market,

A. The price is the interest rate.

B. The supply curve reflects the behavior of borrowers.

C. If interest rates rise, firms borrow more.

D. The demand curve reflects the behavior of lenders.

Answer: A

You might also like to view...

Refer to Figure 12-2. The firm breaks even at an output level of

A) Q1 units. B) Q2 units. C) Q3 units. D) Q4 units.

Suppose the market demand elasticity is constant at -2, and there are three identical firms in the oligopolistic market. A Cournot firm's MPL = 1.2L-0.5, then the labor demand for a Cournot firm is

A) PL-0.5. B) 0.6PL-0.5. C) 0.2PL-2. D) PL-2.

When the Fed sells bonds, the:

A. discount rate increases. B. discount rate decreases. C. federal funds rate increases. D. reserve requirement falls.

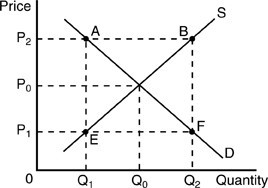

If the market price falls from P0 to P1 in the above figure, then

If the market price falls from P0 to P1 in the above figure, then

A. there will be a further tendency for price to fall. B. there is a surplus of goods on the market equal to the distance Q1, Q2. C. there is a shortage equal to the distance EF. D. a new equilibrium quantity is established.