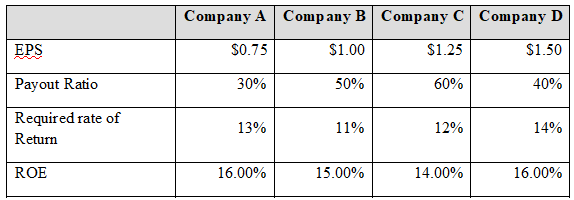

The following table contains information about the estimated next year’s EPS, payout ratio, shareholders’ required rate of return, and return on equity of four different companies:

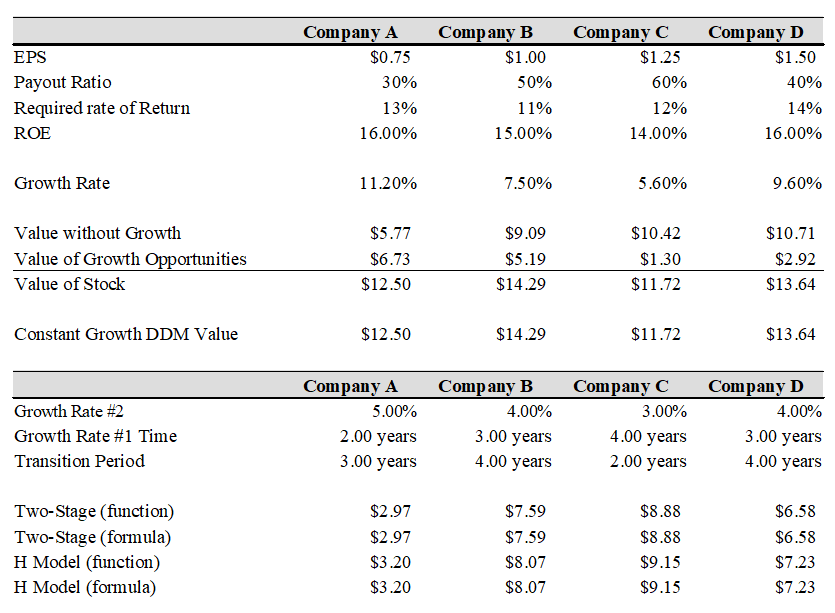

a) Calculate each company’s future earnings growth rate. Using the earnings model, what is the value of the stock?

b) Using the constant-growth dividend discount model, what is the value of the stock?

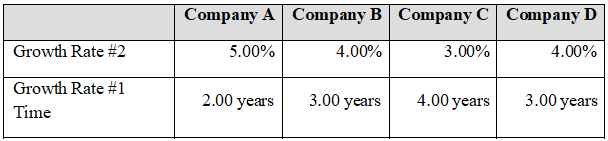

c) Assume that the companies will experience the growth rate determined in part (a) for a short period of time, and after that the firms will grow at a lower rate. These periods of time and second growth rates are the following:

Using the two-stage dividend growth model, what is the value of the stock? Calculate your solution twice, first using equation 9-5 on page 260, and then using the FAME_TwoStageValue function.

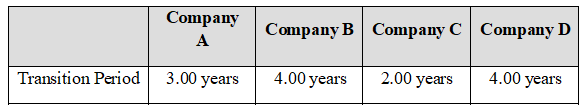

g) Assume that the transition between growth rates 1 and 2 will be gradual rather than instantaneous. The forecasted transition periods are the following:

Using the H model, what is the value of the stock? Calculate your solution twice, first using equation 9-8 on page 264, and then using the FAME_HModelValue user-defined function.

h) Create a Scatter chart to show the relationship between the value of the stock and the dividend payout ratio using Company D. Can you observe any price that is extremely different from the rest? Interpret your results.

e) At a payout ratio of 12.5%, the value of the stock would be essentially infinite. Below that rate, the valuation equation breaks down and gives a negative value because the growth rate is greater than the required return.

You might also like to view...

A $1.00 coupon is placed inside a box of Quaker Oats. This is an example of a(n):

A) instant-redemption coupon B) bounce-back coupon C) cross-ruffing coupon D) response offer coupon

Determine which activities should be crashed to shorten the project by 2 days

What will be an ideal response?

Which of the following are not considered to be suppliers?

A. Web design houses B. art studios C. printers D. film and video production houses E. ad distributors

How does the direct method differ from the indirect method?How does the choice of methods impact the amount of net cash flow from operating activities?

What will be an ideal response?