Supporters of raising the minimum wage argue that minimum-wage laws are

a. a tax-free way to help the working poor. Businesses bear the burden of paying higher wages, not the government.

b. better than the Earned Income Tax Credit (EITC) in targeting the working poor. The EITC may benefit teenagers from middle-class families who work summer jobs at the minimum wage.

c. better than in-kind transfers such as food stamps in providing food rather than unhealthy items such as drugs or alcohol.

d. a way to increase employment of those likely to earn the minimum wage.

a

You might also like to view...

Suppose homebuyers believe that prices will fall over the next six months to a year. This would tend to

A) increase their demand for homes today. B) decrease their demand for homes six months from today. C) decrease their demand for homes today. D) have no effect on their demand today or six months from today.

Refer to Figure 15-8. In the figure above, if the economy is at point A, the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates. B) raise income taxes. C) raise interest rates. D) lower income taxes.

The patented outcome of a research project financed by a private organization is a private good.

Answer the following statement true (T) or false (F)

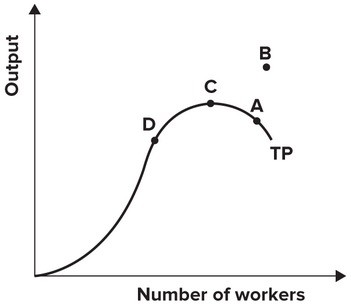

Refer to the graph shown. With efficient production, this firm can maximize production at point:

With efficient production, this firm can maximize production at point:

A. A. B. B. C. C. D. D.