If the government imposes an excise tax on a good equal to $5 per unit and the demand curve for this good is vertical, the supply of this good will shift:

A. downward and the price will decrease by less than $5.

B. downward and the price will decrease by $5.

C. upward and the price will increase by $5.

D. upward and the price will increase by less than $5.

Answer: C

You might also like to view...

Caroline Jahn has a professional degree and is 51 years old. Bob Rubate also has a professional degree and is 29 years old. On average, Caroline most likely earns

a. 75 percent less than Bob b. 7 percent less than Bob c. 75 percent more than Bob d. 7 percent more than Bob e. the same amount as Bob

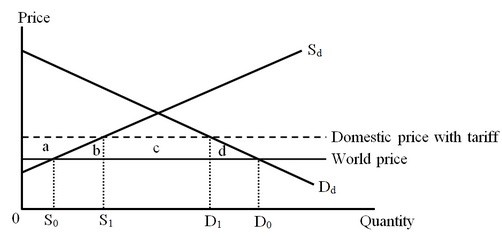

The figure below shows the market for shoes in a small importing country. Dd and Sd are the domestic demand and supply curves of shoes, respectively. The imposition of a tariff on shoes caused economic well-being in the country to ________ by an amount measured by the area

The imposition of a tariff on shoes caused economic well-being in the country to ________ by an amount measured by the area

A. rise; (a + c). B. rise; (b + c+ d). C. fall; c. D. fall; (b + d).

Normative economics is:

a. based on facts b. based on value judgments c. based on the use of the scientific method d. applicable only to macroeconomics

The main way corporations and governments raise money is through

A. the stock market. B. the bond market. C. the equity credit channel. D. loans from banks.