Suppose a firm wants to borrow $200 million for 5 years to fund capital expenditures, and is

considering the choice of a bank loan or a public issue through an investment banking firm as underwriter.

For simplicity, we will assume that in either case the firm will issue pure-discount debt. The bank demands a 10.25% interest rate (with no fee), while the underwriter states that the interest cost will be 9.25 percent with 3% flotation costs. Which funding source provides the lower effective interest cost?

a. the bank loan

b. the public issue

c. both provide exactly the same effective interest cost

B

You might also like to view...

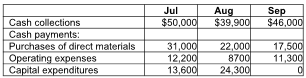

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the final projected cash balance at the end of August taking into consideration all the financing transactions.

Tomo, Inc. has prepared its third quarter budget and provided the following data:

A) $7558

B) $(7442)

C) $47,600

D) $15,000

Holley is starting a new business and is trying to forecast sales. She has owned two other businesses, one of which was in the same industry as this new venture. Discuss the implications for forecasting for the new business. What could she do to increase her forecasting success?

What will be an ideal response?

Immaterial violations of the solicitation rules automatically create income tax nexus.

Answer the following statement true (T) or false (F)

Discuss a worksheet by answering the following questions: a. Why is the preparation of a worksheet not required? b. When a worksheet is used, does a trial balance have to be prepared? Why or why not? c. If the Income Statement and Balance Sheet columns balance, is this proof that the financial statements are correct? Why or why not?