The default-risk premium:

A. should vary directly with the bond's yield and the bond's price.

B. should be lower for a highly speculative bond than for an investment-grade bond.

C. should vary directly with the bond's yield and inversely with its price.

D. is less than 0 (zero) for a U.S. Treasury bond.

Answer: C

You might also like to view...

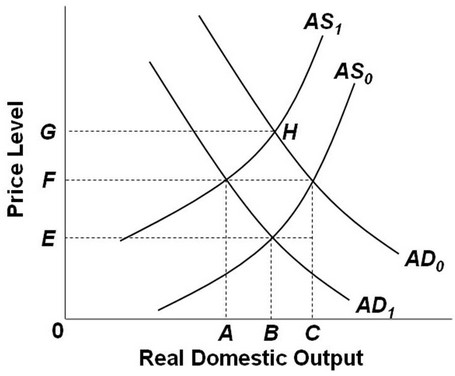

Use the following graph to answer the next question. A shift of the aggregate demand curve from AD1 to AD0 might be caused by a(n) ________.

A shift of the aggregate demand curve from AD1 to AD0 might be caused by a(n) ________.

A. decrease in net export spending B. increase in aggregate supply C. increase in investment spending D. decrease in the amount of output supplied

Assume that foreign capital flows into a nation rise due to expected increases in stock market appreciation. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the GDP Price Index and net nonreserve international borrowing/lending balance in the context of the Three-Sector-Model? a. The GDP Price Index rises and net nonreserve

international borrowing/lending balance becomes more positive (or less negative). b. The GDP Price Index rises and net nonreserve international borrowing/lending balance becomes more negative (or less positive). c. The GDP Price Index falls and net nonreserve international borrowing/lending balance becomes more positive (or less negative). d. The GDP Price Index and net nonreserve international borrowing/lending balance remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

Stagflation is characterized by an...

What will be an ideal response?

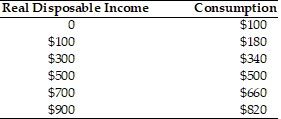

In the above table, saving is positive when real disposable income is greater than

In the above table, saving is positive when real disposable income is greater than

A. $100. B. $300. C. $500. D. zero.