Which of the following two effects of a decrease in the tax rate on saving would raise savings?

a. the income effect and the substitution effect

b. the income effect but not the substitution effect

c. the substitution effect but not the income effect

d. neither the substitution effect nor the income effect

c

You might also like to view...

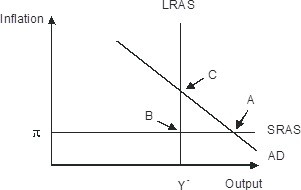

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is Qd = 20,000 - 200P where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. Suppose Kate enters the market first and chooses her output before Alice. What is Alice's profit?

A. $10,000 B. $5,000 C. $20,000 D. $15,000

Which of the following is not a benefit to lenders/investors of financial intermediation?

a. Higher yield than the direct market. b. Lower risks than the direct market. c. More diversification than the direct market. d. All the above are benefits to lenders. e. Lower transaction costs than the direct market.

Successful entrepreneurs

A) do not have to follow government regulations. B) provide new products and job opportunities for others. C) have high consumption rates and relatively low investment rates. D) are not influenced by government tax policies.