Balerio Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:??Average Cost per Unit?Direct materials$6.80?Direct labor$3.20?Variable manufacturing overhead$1.60?Fixed manufacturing overhead$13.50?Fixed selling expense$2.25?Fixed administrative expense$1.80?Sales commissions$0.50?Variable administrative expense$0.40Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?b. If 10,000 units are sold, what is the variable cost per unit sold?c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold?d. If the selling price is $18.20 per unit, what is the contribution margin

per unit sold?e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

What will be an ideal response?

a.

| ? | Direct materials | $6.80 |

| ? | Direct labor | 3.20 |

| ? | Variable manufacturing overhead | 1.60 |

| ? | Variable manufacturing cost per unit | $11.60 |

| ? | ? | ? |

| ? | Total variable manufacturing cost ($11.60 per unit x 9,000 units produced) | $104,400 |

| ? | Total fixed manufacturing overhead cost ($13.50 per unit x 9,000 units produced) | 121,500 |

| ? | Total product (manufacturing) cost | $225,900 |

b.

| ? | Direct materials | $6.80 |

| ? | Direct labor | 3.20 |

| ? | Variable manufacturing overhead | 1.60 |

| ? | Sales commissions | 0.50 |

| ? | Variable administrative expense | 0.40 |

| ? | Variable cost per unit sold | $12.50 |

c.

| ? | Variable cost per unit sold (a) | $12.50 |

| ? | Number of units sold (b) | 10,000 |

| ? | Total variable costs (a) x (b) | $125,000 |

d.

| ? | Selling price per unit | ? | $18.20 |

| ? | Direct materials | $6.80 | ? |

| ? | Direct labor | 3.20 | ? |

| ? | Variable manufacturing overhead | 1.60 | ? |

| ? | Sales commissions | 0.50 | ? |

| ? | Variable administrative expense | 0.40 | ? |

| ? | Variable cost per unit sold | ? | 12.50 |

| ? | Contribution margin per unit | ? | $5.70 |

e.

| ? | Direct materials | $6.80 |

| ? | Direct labor | 3.20 |

| ? | Variable manufacturing overhead | 1.60 |

| ? | Incremental manufacturing cost | $11.60 |

You might also like to view...

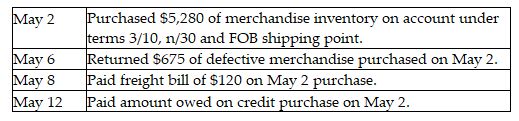

Journalize the following purchase transactions for Rocky's Swimming Pool Supply Company using the periodic inventory system. Explanations are not required.

In a monetary-unit sampling plan, the upper misstatement limit is $11,200 and the risk of incorrect acceptance is 5%. This means that:

A. there is a 95% chance that the actual misstatement in the account is $11,200 or more. B. there is a 95% chance that the actual misstatement in the account is $11,200 or less. C. there is a 95% chance that the actual misstatement in the account is $11,200. D. tolerable misstatement is $11,200.

Indirect exports have two advantages for a firm: less investment and less ________

A) paperwork B) intrusion by the government C) risk D) competition E) customer suits

Omega Corporation uses process costing to calculate the cost of manufacturing pool systems. Beginning work in process included 30,00 . units 60 percent complete. During the month 170,00 . units were completed, 20,00 . units remain in work in process at 80 percent complete. Using the average cost method, the equivalent units are:

a. 170,000 b. 196,000 c. 186,000 d. 190,000