Explain how changes in the proportion of contracts that are indexed affect how a given change in monetary policy will affect economic activity

What will be an ideal response?

An increase in nominal money growth will increase the real money supply causing an increase in economic activity. As the proportion of labor contracts that are indexed increases, the effects of changes in unemployment on inflation would increase. A reduction in u will cause an increase in inflation. When inflation rises in a period, some contracts (those that are indexed) will call for an immediate increase in wages further increasing inflation within that period. As indexation becomes more prevalent, that secondary effect on inflation will be magnified. This magnification of the inflation effect will cause the real money supply to increase by a smaller amount and, therefore, reduce the output effects of a given monetary expansion.

You might also like to view...

What do the Monetarist and Keynesian economists claim was the main cause of the Great Depression?

(a) A contraction in supply (b) A downturn in demand (c) The falling federal deficit (d) All of the above

Which of the following would shift the demand curve for autos to the right?

a. A fall in the price of autos. b. A fall in the price of auto insurance. c. A fall in consumers' incomes. d. A fall in the price of steel.

When a person pays a loan back to a bank by writing a check for the amount due, demand deposits decline and the money supply is reduced

a. True b. False Indicate whether the statement is true or false

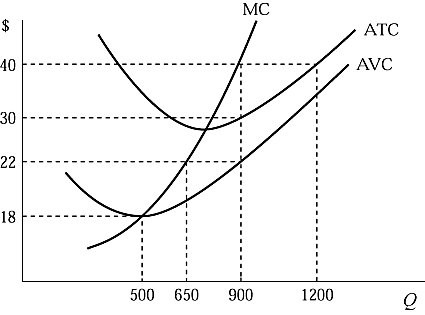

Figure 6.1 shows the cost structure of a firm in a perfectly competitive market. If the market price is $40 and the firm is currently producing the profit-maximizing output level, its total fixed cost is:

Figure 6.1 shows the cost structure of a firm in a perfectly competitive market. If the market price is $40 and the firm is currently producing the profit-maximizing output level, its total fixed cost is:

A. $2,800. B. $5,200. C. $7,200. D. $9,000.