Why are policymakers reluctant to make unconventional tools part of their regular arsenal of policy tools?

What will be an ideal response?

Primarily continued uncertainty about how and why they work and how to apply them effectively. Effective monetary policymaking rests on well-established quantitative relationships of the impact of a change in the target interest rate on the central bank objective. Such relationships with unconventional tools are unknown. A second reason is that an exit from an unconventional strategy is uncertain and may be difficult. A third reason is that some unconventional policy tools have a fiscal character that could invite greater political scrutiny of the central bank, diminishing its independence.

You might also like to view...

A belief that demand shocks are an important source of business cycle fluctuations implies a preference of ________

A) the new Keynesian model over the traditional Keynesian model B) the real business cycle model over the traditional Keynesian model C) the real business cycle model over the new Keynesian model D) the new Keynesian model over the real business cycle model

Which of the following is true of M1? a. It is equal to M2

b. It consists of all near-monies. c. It consists of certificates of deposit. d. It is the broader definition of money. e. It is only a fraction of M2.

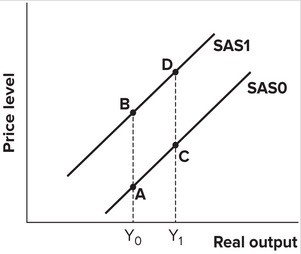

Refer to the graph shown. A decrease in aggregate demand in the short run is likely to cause a movement from:

A. B to A. B. B to D. C. C to D. D. C to A.

In the long run

A. all firms must make economic profits. B. a firm can vary all inputs, but it cannot change the mix of inputs it uses. C. there are no fixed factors of production. D. a firm can shut down, but it cannot exit the industry.