An insurance policy is a product that:

A. involves a company paying individuals very large sums of money if they encounter any risk.

B. involves individuals paying a regular fee in return for an agreement that the insurance company will cover all expenses associated with risky behavior.

C. involves individuals paying a company to ensure they don't experience any risk.

D. allows people to pay to reduce uncertainty in some aspect of their lives.

Answer: D

You might also like to view...

As a firm expands its output, cost per unit of output (average cost) decreases and then increases. Average cost and output have

A) a relationship with a minimum. B) a relationship with a maximum. C) no relationship. D) a linear positive relationship.

Wendy claims that the right mix of hamburgers and other goods is being produced, but that they are not being produced in the least costly way. How would an economist assess Wendy's claim?

A. Wendy is asserting that productive efficiency is realized in hamburger production, but not allocative efficiency. Wendy's assertion cannot be correct. B. Wendy is asserting that allocative efficiency is realized in hamburger production, but not productive efficiency. Wendy's assertion may be correct. C. Wendy is asserting that productive efficiency is realized in hamburger production, but not allocative efficiency. Wendy's assertion may be correct. D. Wendy is asserting that allocative efficiency is realized in hamburger production, but not productive efficiency. Wendy's assertion cannot be correct.

Suppose that there is an improvement in technology in the market for Samsung phones. Which of the following is TRUE?

A) Supply will increase and the market clearing price will fall. B) Supply will increase and the market clearing price will rise. C) Demand will increase and the market clearing price will rise. D) Demand will increase and the market clearing price will fall.

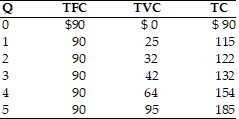

Refer to the above table. What is MC when output rises from 0 unit to 1 unit?

Refer to the above table. What is MC when output rises from 0 unit to 1 unit?

A. $90 B. $0 C. $25 D. $115