Which of the following is true regarding government expenditures in the United States?

a. As a share of GDP, government expenditures were higher in 1950 than 2012.

b. Government expenditures were more than 30 percent of GDP in 1930.

c. Government expenditures as a share of GDP grew rapidly between 1930 and 1980.

d. In 2012, government expenditures at all levels summed to approximately 10 percent of GDP.

C

You might also like to view...

What role do business firms play in output markets and in factor markets?

What will be an ideal response?

According to Laffer (of the Laffer curve), the Kemp-Roth tax cut of 1981 should have caused

a. tax revenue to rise, and it did b. tax revenue to fall, and it did c. people to increase saving, and it did d. people to increase consumption spending, but it didn't e. tax revenue to rise, but it didn't

Assume that for good X the supply curve for a good is a typical, upward-sloping straight line, and the demand curve is a typical downward-sloping straight line. If the good is taxed, and the tax is doubled, the

a. base of the triangle that represents the deadweight loss doubles. b. height of the triangle that represents the deadweight loss doubles. c. deadweight loss of the tax quadruples. d. All of the above are correct.

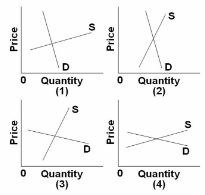

In which of the given market situations will the efficiency loss of an excise tax be the greatest?

A. 4.

B. 3.

C. 1.

D. 2.