"A country can be worse off as a result of free trade in an exported product if there are no policies that force market decision-makers to internalize the external costs associated with the domestic production of this product." Do you agree or disagree with the statement? Illustrate your answer with the help of relevant diagrams.

What will be an ideal response?

POSSIBLE RESPONSE: Consider the case of an industry whose production activity creates substantial pollution in the local rivers, lakes, and groundwater. For example, it is convenient for chemical companies to dump their chemical wastes into nearby lakes and water bodies. This may not impose any cost on the firms. However, the dumping of wastes into the lakes imposes an external cost on other members of society.

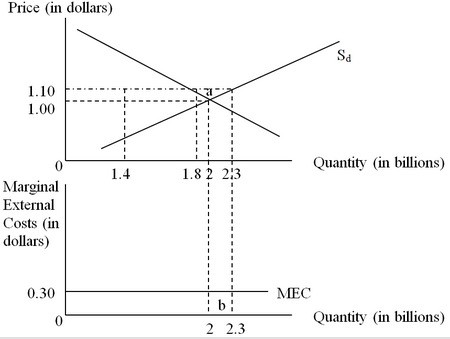

In the diagrams above, let's assume that the domestic firms ignore the marginal external costs (MEC, as shown in the lower panel) of their pollution and operate on supply curve Sd (as shown in the upper panel). In the absence of trade, the local price is $1.00, and domestic quantity produced and consumed is 2 billion units (as shown in the upper panel). If this country engages in free trade and the world price is $1.10, the country exports (2.3 - 1.8) = 0.5 billion units.

However, in comparison with no trade, the country may be worse off, since the gain from the triangular area depicted by 'a' may be less than the rectangular Area 'b', which shows the additional external costs resulting from the expansion of domestic production. In the case shown in the diagram above, Area a is $25 million, and Area b is $90 million, so this country is worse off for exporting the product.

You might also like to view...

Since its inception in 1913, there have been many revisions to the income tax code.

A. True B. False C. Uncertain

If the government places a $0.50 tax on an item for which demand is perfectly elastic

A) the entire tax will be paid by the consumer. B) the tax will be split equally between the consumer and producer, with each paying exactly $0.25. C) most of the tax will be paid by the consumer. D) the entire tax will be paid by the producer.

Whenever a decrease in output leads to an increase in profit, the

a. marginal revenue curve lies above the marginal cost curve b. total cost curve intersects the total revenue curve c. marginal cost curve is parallel to the marginal revenue curve d. marginal cost curve lies above the marginal revenue curve e. total cost curve lies above the total revenue curve

If a price is below equilibrium,

A. A shortage will cause the price to rise and the quantity supplied to increase. B. A surplus will cause the price to fall and the quantity supplied to increase. C. A surplus will cause the price to fall and the quantity supplied to decrease. D. A shortage will cause the price to fall and the quantity supplied to decrease.