P/E ratios could rise even as earnings fall if

A) earnings fall at a faster rate than stock prices.

B) earnings fall at a slower rate than stock prices.

C) investors expect lower stock prices to be permanent.

D) investors expect lower earnings to be permanent.

Answer: A

You might also like to view...

On what information does the auditor base a going concern evaluation?

a. On separate procedures. b. On the management discussion and analysis (MD&A). c. On information obtained from normal audit procedures performed to test management's assertions. d. On the statement of cash flows for the current period.

On January 1, 20X7, Pisa Company acquired 80 percent of Siena Company by purchasing 40,000 shares of Siena's common stock. There was no differential related to this transaction. The noncontrolling interest had a fair value equal to 20 percent of book value. The book value of Siena on December 31, 20X7 was as follows: Common Stock ($10 par value)$500,000 Retained Earnings 350,000 Total$850,000 On January 1, 20X8, Pisa purchased an additional 12,500 shares directly from Siena for $25 per share.Based on the preceding information, the ending balance in Additional Paid-In Capital would be:

A. $187,500 B. $0 C. $312,500 D. $125,000

A run-out policy of product deletion

A. lets the product decline without changing the product strategy. B. is an immediate-drop decision. C. exploits any strengths left in the product. D. raises the price of the product continually to secure as much profit as possible before the product is priced out of the market. E. occurs when production cannot keep pace with demand because of material shortages.

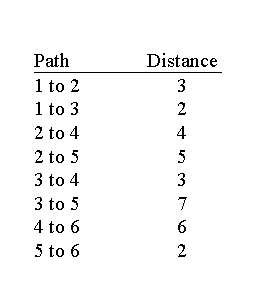

Consider the following shortest-route problem involving six cities with the distances given. Draw the network for this problem and formulate the LP for finding the shortest distance from City 1 to City 6.

What will be an ideal response?