If the demand curve is perfectly elastic, the burden of a tax on suppliers is borne:

A. partly by the suppliers and mostly by the consumers if the supply curve is elastic.

B. mostly by the suppliers and partly by the consumers if the supply curve is inelastic.

C. entirely by the consumers.

D. entirely by the suppliers.

Answer: D

You might also like to view...

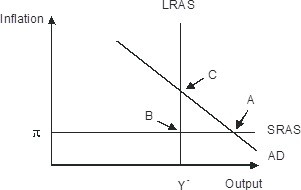

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

An increase in the money supply is likely to reduce

A. money demand. B. interest rates. C. the general price level. D. nominal income.

Refer to the above figure. A unit tax has been placed on the good. What is the total amount of the tax?

A) 0 B) P2 - P0 C) P2 - P1 D) P1 - P0

Refer to the accompanying table. Martha's opportunity cost of making a cake is: Time to Make a PieTime to Make a CakeMartha60 minutes80 minutesJulia50 minutes60 minutes

A. 4/3 of a pie. B. 60 pies. C. 3/4 of a pie. D. 6 pies.