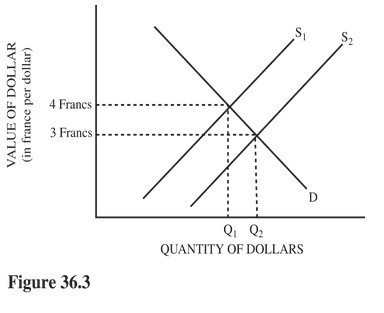

Refer to Figure 36.3 for the dollar-Swiss franc foreign exchange market. Which of the following is true?

Refer to Figure 36.3 for the dollar-Swiss franc foreign exchange market. Which of the following is true?

A. An increase in supply from S1 to S2 could be caused by an increase in the U.S. demand for Swiss chocolate.

B. An increase in supply from S1 to S2 could be caused by an increase in Swiss demand for U.S. corn.

C. The U.S. dollar appreciates in value compared to the franc when supply increases from S1 to S2.

D. The Swiss franc appreciates in value compared to the U.S. dollar when supply decreases from S2 to S1.

Answer: A

You might also like to view...

Which of the following could decrease the equilibrium price but increase the equilibrium quantity of apples?

a. Higher wages are paid to the agricultural workers who harvest the apples. b. A rise in the cost of treating pests destroying apples. c. Many new apple orchards are planted. d. An increase in the market supply of grapefruit.

Three candidates for political office disagree over the benefits of enlarging the federal budget deficit

Candidate C says the stimulation package is needed to increase employment and real GDP; Candidate D says it will only cause higher prices; and Candidate F says it will have no effect on either real GDP or the price level. How do the three candidates differ with respect to the condition of the economy and the effects of fiscal policy? A) Candidate C thinks the simple Keynesian model is applicable, while D thinks the expansionary policy will fully crowd out private investment. F believes the economy is experiencing a recessionary ga

The Classical macroeconomic model proposes that

A) real GDP equals potential GDP as long as inflation equals zero. B) government intervention is required to help the economy reach its potential. C) changes in the quantity of money are critical in driving economic growth. D) socialism produces the most efficient economic outcomes for a society. E) markets work efficiently to produce the best macroeconomic outcomes.

Comparing the European and the U.S. central bank systems, the National Central Banks that make up part of the European System of Central Banks resembles:

A. the U.S. Treasury. B. the regional Federal Reserve Banks. C. the FOMC. D. the Board of Governors.