(Last Word) Which of the following explanations argues that the Great Recession resulted from asset-price bubbles caused by euphoria and debt-fueled speculation?

A. Minsky explanation.

B. Austrian explanation.

C. Stimulus explanation.

D. Structural explanation.

Answer: A

You might also like to view...

The consumption function is the relationship between ________, other things remaining the same

A) consumption expenditure and net taxes B) net taxes and disposable income C) consumption expenditure and the price level D) consumption expenditure and disposable income E) consumption expenditure and saving

Empirical studies of production suggest that the long-run average cost curve

a. is U-shaped b. has an inverted L shape c. is L-shaped d. is horizontal e. shows diminishing marginal returns

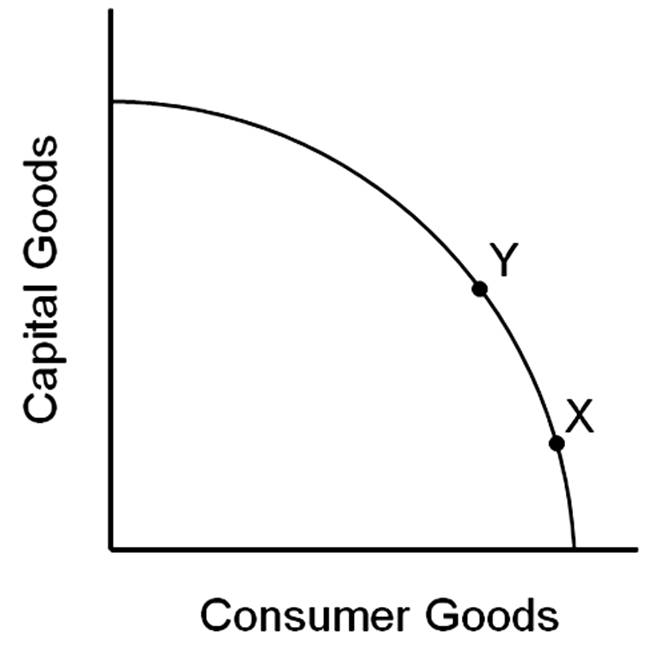

Imagine that a country is at point X of this production possibilities frontier and a country is at point Y.

A. The country at point X will probably grow faster than the country at point Y.

B. The country at point Y will probably grow faster than the country at point X.

C. The two countries will probably grow at about the same speed.

D. There is no way of predicting which country will grow faster.

Your local government needs to increase tax revenue. To increase tax revenue it can either increase the property tax on residential property or increase the property tax on all property. The government wants to impose the smallest excess burden possible. What would your recommendation be?

A. to increase the property tax on all property, because this tax would be less regressive than a tax only on residential property B. to increase the property tax only on residential property because this tax cannot be shifted C. to increase the property tax on all property because the demand for all property is less elastic than the demand for residential property D. to increase the property tax only on residential property because taxpayers are allowed to deduct property taxes from their federal income tax liability, thus reducing the amount they must pay in federal taxes