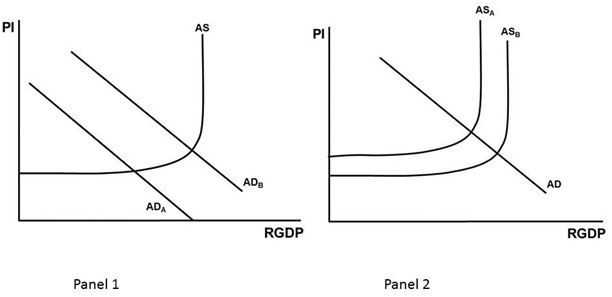

Using Figure 48.1, modeling the attacks of September 11, 2001, you would show the aggregate supply shock by using  Figure 48.1

Figure 48.1

A. Panel 1 only with a shift from ADA to ADB.

B. Panel 2 only with a shift from ASB to ASA.

C. Panel 1 only with a shift from ADB to ADA.

D. Panel 1 to model the aggregate demand shock (ADB to ADA) and Panel 2 to model the aggregate supply shock (ASB to ASA).

Answer: B

You might also like to view...

A product is produced in a monopolistically competitive industry with scale economies. If this industry exists in two countries, and these two countries engage in trade with each other, then we would expect

A) each country will export different varieties of the product to the other. B) the country in which the price of the product is lower will export the product. C) the country with a relative abundance of the factor of production in which production of the product is intensive will export this product. D) neither country will export this product since there is no comparative advantage. E) the countries will trade only with other nations they are not in competition with.

If Second National Bank has more rate-sensitive liabilities then rate-sensitive assets, it can reduce interest rate risk with a swap that requires Second National to

A) pay fixed rate while receiving floating rate. B) receive fixed rate while paying floating rate. C) both receive and pay fixed rate. D) both receive and pay floating rate.

Because most asset yields are affected in a systematic way by economic conditions, most securities in portfolios

A) have a covariance greater than zero. B) have negative yields. C) have covariance greater than one. D) increase in risk as new assets are added.

Assuming a required reserve ratio of 8%, interest rate on reserves of 0.5%, and interest rate on loans of 4%, what is the effective cost of the reserve requirement on a $1000 deposit?

A) 0.05% B) 0.28% C) 0.32% D) 4%