Assuming seigniorage equals zero, the federal debt is ________ and the budget deficit is ________

A) a flow variable representing the total value of government bonds outstanding; a stock variable representing the yearly increase in value of newly issued government bonds

B) a stock variable representing the total value of government bonds outstanding; a flow variable representing the yearly increase in value of newly issued government bonds

C) a flow variable representing the yearly increase in value of newly issued government bonds; a stock variable representing the total value of government bonds outstanding

D) a stock variable representing the yearly increase in value of newly issued government bonds; a flow variable representing the total value of government bonds outstanding

B

You might also like to view...

The more closely substitutable are two goods, the

A) more normal looking is the indifference curve for the two items. B) more closely the indifference curve for these two items approximates a straight line. C) more tightly curved is the indifference curve for these items. D) None of the above answers is correct.

How are the fundamental economic questions answered in a market economy?

A) Large corporations alone decide the answers. B) Households and firms interact in markets to decide the answers to these questions. C) Individuals, firms, and the government interact in markets to decide the answers to these questions. D) The government alone decides the answers.

A market with three firms in competition with each other has a equilibrium price of $5 and equilibrium quantity of 10,000. If the three firms form a cartel, the cartel, set price will be ________ than $5 and the set quantity will be ________ than 10,000.

A) greater; less B) less; greater C) greater; greater D) less; less

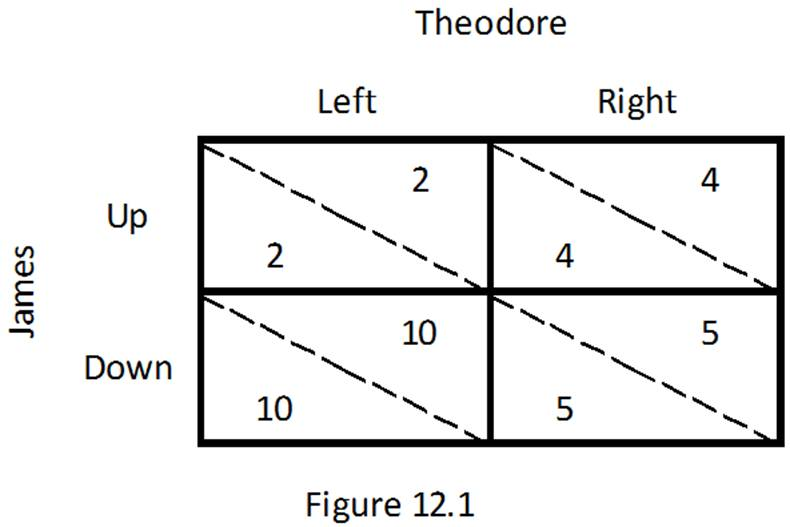

Refer to the game between James and Theodore depicted in Figure 12.1. Who has a dominant strategy?

A. Only James

B. Only Theodore

C. Both James and Theodore

D. Neither James nor Theodore