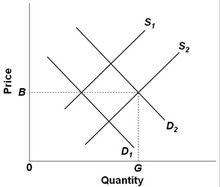

Use the following competitive market diagram for product Z to answer the question below. Assume that the current market demand and supply curves for Z are D1 and S1. If there are substantial external consumption benefits associated with the production of Z, then

Assume that the current market demand and supply curves for Z are D1 and S1. If there are substantial external consumption benefits associated with the production of Z, then

A. government can improve the allocation of resources by imposing a per-unit tax on Z.

B. government can improve the allocation of resources by subsidizing consumers of Z.

C. a government subsidy for producers of Z would ensure that consumers are paying directly for all benefits they receive from Z.

D. consumers are paying too much for the good.

Answer: B

You might also like to view...

Gross Domestic Product (GDP) is the total market value of all

A) final goods and services produced annually within a country's borders. B) final and intermediate goods and services produced annually within a country's borders. C) intermediate goods and services produced annually within a country's borders. D) final goods produced every month within a country's borders.

A 2009 article in The Economist noted that

a. recent research has allowed economists to estimate the values of fiscal multipliers with a great deal of precision. b. research on multipliers indicates that multipliers for permanent tax cuts tend to be smaller than multipliers for temporary tax cuts. c. most of the evidence on multipliers for government spending is based on changes in military expenditures. d. All of the above are correct.

Which of the following is NOT one of the main goals of monetary policy?

A. Controlling inflation B. Ensuring financial stability C. Smoothing out the business cycle D. Balancing the federal budget

Define “earmarks” and give an example

Please provide the best answer for the statement.