Division S sells its product to unrelated parties at a price of $20 per unit. It incurs variable costs of $7 per unit and has fixed costs of $50,000 per month. Monthly production is generally 10,000 units.Division B uses Division S's product in its operations. It can purchase the units from Division S at $20 per unit but must pay $1.50 per unit in shipping costs. Alternatively, Division B can buy from Division S's competition at a delivered price of $21 per unit.Required:(a) From the company's perspective, should Division B purchase the units internally or externally? Assume Division S has ample capacity to handle all of Division B's needs.(b) Would your answer change if Division S can sell everything it produces to outside customers?

What will be an ideal response?

(a)

The external cost is $21 and the internal cost is $8.50 ($7 variable cost + $1.50 shipping). Division B should purchase the units internally because it would result in cost savings of $125,000 [($21 ? $8.50) × 10,000 units].

(b)

If Division S can sell everything it produces to outside customers, Division B should purchase the units externally. The transfer price would be market because Division S is operating at capacity. Purchasing internally would cost $21.50 ($20 + $1.50) per unit while purchasing externally would cost $21 per unit.

You might also like to view...

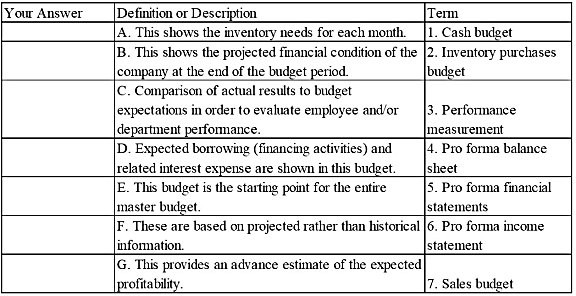

Select the term from the list of terms that best matches the description provided.

What will be an ideal response?

The product-market expansion grid, like the BCG matrix, is used to identify growth opportunities

Indicate whether the statement is true or false

Research examining successful negotiators suggests that expert, experienced, and otherwise superior negotiators behave no differently than average negotiators.

Answer the following statement true (T) or false (F)

When copyrighted material is used for purposes of criticism, news reporting, teaching, scholarship, and research, what does it constitute?

A) fair use B) infringement C) commissioned work D) publicity