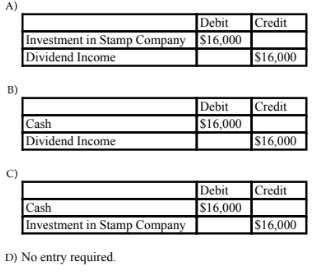

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through profit or loss, what entry will the company make to record the dividends received from Stamp Company for 2016?

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2016, for a cash consideration of $200,000. During 2016, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2016, shares of Stamp Company were trading for $11 each.

You might also like to view...

U.S. v. Microsoft held that the appropriate standard for analyzing Microsoft's actions in the browser market was the rule of reason.

Answer the following statement true (T) or false (F)

Product C is one of several joint products that come out of Department M. The joint costs incurred in Department M total $40,000. Product C can be sold at split-off or processed further and sold as a higher quality item. The decision to process further should be based on the:

A. Allocation of the $40,000, using the net realizable value. B. Allocation of the $40,000, using the relative sales value at split-off method. C. Allocation of the $40,000, using a physical measures approach. D. Assumption that the $40,000 is irrelevant.

Which of the following is an element of surface-level diversity?

A. values B. beliefs C. attitudes D. race

It may be appropriate to combine country-level screening with screening at the consumer level because consumers who, because of their similarities, comprise a single segment may reside in different countries. True/False?

(a) True (b) False