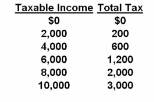

Refer to the table. If your taxable income is $8,000, your average tax rate is:

A. 25 percent and the marginal rate on additional income is also 25 percent.

B. 25 percent and the marginal rate on additional income is 40 percent.

C. 25 percent and the marginal rate on additional income cannot be determined from the

information given.

D. 20 percent and the marginal rate on additional income is 30 percent.

B. 25 percent and the marginal rate on additional income is 40 percent.

You might also like to view...

Which of the following represents a problem in measuring inequality?

a. Measurements of income distributions typically include in-kind transfers, which distort the measure of inequality. b. A normal life-cycle pattern causes inequality in the income distribution but may not reflect inequality in living standards. c. Transitory income is a better measure of inequality than permanent income. d. Both a and b are correct.

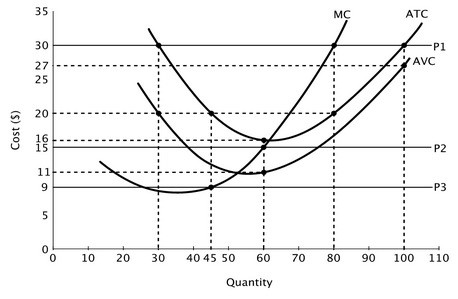

Refer to the accompanying graph. If this firm is a price taker, then when the price of each unit of output is $30, how much profit does this firm earn at its profit-maximizing level of output?

A. $800 B. $1,600 C. $1,200 D. $500

The assumption that a firm operates in a competitive labor market means that the firm

A. does not use capital in the production process. B. offers a real wage rate that is indexed for inflation. C. faces an upward-sloped marginal cost of labor curve. D. faces a downward-sloped marginal cost of labor curve. E. faces a constant wage regardless of how much labor it employs.

When the level of aggregate production is less than the potential output level, this implies that unemployment is high. Jobs are scarce and workers are abundant, which causes nominal wages to fall over time. The SRAS will shift to the left, moving the short run level of aggregate production closer to the potential output level.

Indicate whether the statement is true or false.