No benefits are realized from the research expenditures until next year. The corporation does not claim Sec. 179 or bonus depreciation on any of its assets. If Bauer Corporation elects to expense the research expenditures, the deduction is

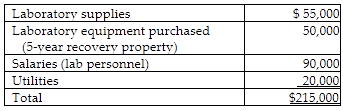

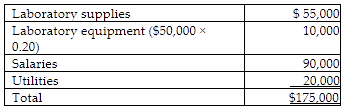

This year Bauer Corporation incurs the following costs in development of new products:

A) $10,000 this year and $175,000 next year.

B) $175,000 next year.

C) $175,000 this year.

D) $215,000 this year.

C) $175,000 this year.

Deductible costs include:

Depreciation on lab equipment is determined from five-year factor, Table 1 in Appendix C.

You might also like to view...

RFID supports procurement.

Answer the following statement true (T) or false (F)

The fundamental starting point of all the accounting statements is the ________

A) accounting identity B) computing identity C) investing identity D) financing identity

Case (A) Case (B) Case (C)Beginning Balance (BB)$36,520 $15,100 $5,600 Ending Balance (EB) ? 11,400 12,200 Transferred In (TI) 166,200 ? 68,400 Transferred Out (TO) 164,400 93,200 ? For Case (B) above, what is the Transferred-In (TI)?

A. $96,900. B. $66,700. C. $119,700. D. $89,500.

Stopher Incorporated makes a single product-a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Budgeted variable manufacturing overhead$45,220 Budgeted production (a) 20,000unitsStandard hours per unit (b) 1.90machine-hoursBudgeted hours (a) × (b) 38,000machine-hours Actual production (a) 21,000unitsStandard hours per unit (b) 1.90machine-hoursStandard hours allowed for the actual production (a) × (b) 39,900machine-hours Actual variable manufacturing overhead$66,789 Actual hours 36,900machine-hoursThe variable component of the

predetermined overhead rate is closest to: A. $1.81 per machine-hour B. $1.19 per machine-hour C. $1.76 per machine-hour D. $1.67 per machine-hour