If their only concern were the cost of issuing municipal debt, how would you expect the mayors of most U.S. cities to respond to a revenue-neutral change in the federal income tax that sharply lowered the top marginal tax rate?

A. No reaction, this should have no impact on municipal bonds at all.

B. Favorably, the price of municipal bonds should increase and their yields fall.

C. Unfavorably, the demand for municipal bonds will fall and their yields will increase.

D. Favorably, since this will significantly increase the demand for municipal bonds.

Answer: C

You might also like to view...

Steve owns a motorcycle valued at $5,000, and that is his only asset. There is a 5 percent chance that Steve will have an accident within a year. If he does have an accident, his motorcycle is worthless

Steve's utility of wealth curve is shown in the figure above. An insurance company agrees to pay Steve the full value of his motorcycle in case of an accident if he buys the company's insurance policy. The company's operating expenses are $500 per policy. With no insurance, Steve's expected wealth is A) $4,000. B) $4,500. C) $3,500. D) $5,000.

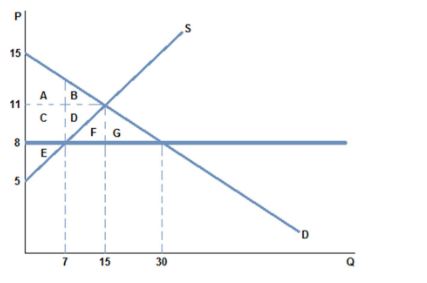

If a price ceiling of $8 were placed on the market in the graph shown, which area represents the surplus that is transferred from producers to consumers?

A. C + D + F + G

B. C + D

C. F + G

D. C

If an auto dealer wants to hire a salaried salesman but is afraid of facing the adverse selection problem, the principle can

a. Hire a salesman who has a reputation for working hard b. Monitor the salesman to prevent shirking c. All of the above d. None of the above

The average-total-cost curve intersects

a. average fixed cost at the minimum of average total cost. b. average variable cost at the minimum of average total cost. c. marginal cost at the minimum of average total cost. d. marginal cost at the minimum of marginal cost.