Sales taxes on consumer goods are regressive because poor people consume a larger proportion of their incomes than do rich people.

Answer the following statement true (T) or false (F)

True

You might also like to view...

“If it were not for the law of diminishing marginal returns, the world’s wheat could be grown in a flower pot.” Explain.

What will be an ideal response?

If Pete raises his price of muffins from $2 to $3 and his total revenue increases from $35,000 to $38,000, then:

A. the demand for Pete's muffins in this range is elastic. B. the demand for Pete's muffins in this range is inelastic. C. the demand for Pete's muffins in this range is unit elastic. D. the percentage change in quantity demanded must exceed the percentage change in product price.

Second-degree price discrimination:

A. is the practice of posting a discrete schedule of declining prices for different ranges of quantities. B. results in transfer pricing. C. eliminates the problem of double marginalization. D. None of the answers are correct.

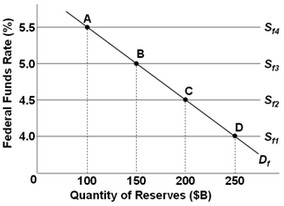

Use the following graph to answer the next question. If the federal funds market is at equilibrium at point B and the Federal Reserve decides to change the rate by a percentage point in order to reduce the chances of the economy going into recession, the supply of funds curve will have to shift to ________.

If the federal funds market is at equilibrium at point B and the Federal Reserve decides to change the rate by a percentage point in order to reduce the chances of the economy going into recession, the supply of funds curve will have to shift to ________.

A. Sf1 B. Sf2 C. Sf3 D. Sf4