Immediately prior to the admission of Allen, the Sanson-Jeremy Partnership assets had been adjusted to current market prices, and the capital balances of Sanson and Jeremy were $80,000 and $120,000 respectively. If the parties agree that the business is worth $240,000, what is the amount of bonus that should be recognized in the accounts at the admission of Allen?

a. $60,000

b. $80,000

c. $40,000

d. $100,000

c

You might also like to view...

All states limit the number of permanent visas that they grant to immigrants

Indicate whether the statement is true or false

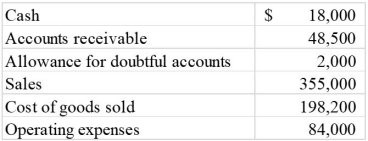

The following information is taken from the adjusted trial balance of the Studio Art Supply Company at the end of Year 1: Studio Art Supply offers all of its charge customers the credit terms, 2/10, n/30.Required:a) Compute the accounts receivable turnover.b) Compute the average number of days to collect accounts receivable. Round your answer to a whole number for days.c) Comment on the meaning of these ratios and specifically on how well this firm is managing its accounts receivable.

Studio Art Supply offers all of its charge customers the credit terms, 2/10, n/30.Required:a) Compute the accounts receivable turnover.b) Compute the average number of days to collect accounts receivable. Round your answer to a whole number for days.c) Comment on the meaning of these ratios and specifically on how well this firm is managing its accounts receivable.

What will be an ideal response?

A company must repay the bank a single payment of $20,000 cash in 3 years for a loan it entered into. The loan is at 8% interest compounded annually. The present value factor for 3 years at 8% is 0.7938. The present value of an annuity factor for 3 years at 8% is 2.5771. The present value of the loan (rounded) is:

A. $7,761. B. $20,000. C. $15,876. D. $51,542. E. $25,195.

Juanita knits blankets as a hobby and sells them. In the current year, she earns $5,000 from her blanket sales and incurs expenses of $600. On her tax return, she should

A. report no hobby income and no hobby deductions. B. report $5,000 of hobby income and deduct $600 of hobby expenses for AGI. C. report $5,000 of hobby income, but she will not be able to take any deductions. D. report $5,000 of hobby income and deduct $600 of hobby expenses from AGI.