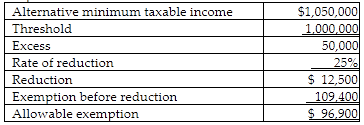

Reva and Josh Lewis had alternative minimum taxable income of $1,050,000 in 2018 and file a joint return. For purposes of computing the alternative minimum tax, their exemption is

A) $96,900.

B) $59,400.

C) $0.

D) $109,400.

A) $96,900.

You might also like to view...

Industry around the world accounts for approximately how much of the world’s total carbon emissions (choose the closest answer)?

a. 1% b. 5% c. 10% d. 20%

Pressures to improve the ethical "climate" of a company come from:

a. other managers, as businesses become less hierarchical b. boards of directors c. federal statutes d. customers e. all of the other choices can be correct

The fourth step in recording a transaction in the general journal is to record the:

A) explanation of the entry. B) account(s) to be credited and the amount(s). C) date of the entry. D) account(s) to be debited and the amount(s).

Services are products that can be touched and felt.

Answer the following statement true (T) or false (F)