The risk-free rate is 6%; Stock A has a beta of 1.0; Stock B has a beta of 2.0; and the market risk premium, rM? rRF, is positive. Which of the following statements is CORRECT?

A. Stock B's required rate of return is twice that of Stock A.

B. If Stock A's required return is 11%, then the market risk premium is 5%.

C. If Stock B's required return is 11%, then the market risk premium is 5%.

D. If the risk-free rate remains constant but the market risk premium increases, Stock A's required return will increase by more than Stock B's.

E. If the risk-free rate increases but the market risk premium stays unchanged, Stock B's required return will increase by more than Stock A's.

Answer: B

You might also like to view...

Before crashing, direct costs for an activity represent normal costs, which typically mean low-cost, efficient methods for completing the activity in a(n) ________ amount of time.

A. Targeted B. Optimized C. Expected D. Budgeted E. Normal

Unit product cost calculations using absorption costing do NOT include ________.

A) fixed manufacturing overhead B) variable manufacturing overhead C) variable selling and administrative costs D) direct materials

Answer the following statements true (T) or false (F)

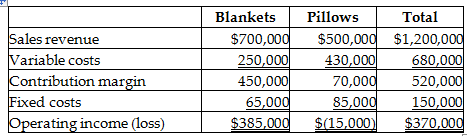

The income statement for Nighty Night, Inc. is divided into two product lines, blankets and pillows, as follows:

Nighty Night, Inc. should eliminate the pillows product line only, if by doing so, they can eliminate more than $70,000 of fixed costs.

The UCC deals with unconscionability in a contract by providing that a court may:

a. refuse to enforce the contract. b. enforce the remainder of the contract without the unconscionable clause. c. limit the application of any unconscionable clause as to avoid any unconscionable result. d. All of the above.