A tax levied on the purchase of a specific good or service is

A. a purchase tax.

B. a value tax.

C. an excise tax.

D. a consumption tax.

Answer: C

You might also like to view...

The switch from AFDC to TANF took place in

A. 1937. B. 1986. C. 1996. D. 1998.

Concepts useful in evaluating the costs and benefits of alternative types of taxes are:

A. efficiency, incidence and scarcity. B. revenue, scarcity, and shortage. C. incidence, scarcity, and shortage. D. efficiency, revenue and incidence.

A price ceiling placed on a market for rental apartments is called

a. rent control b. rent subsidy c. apartment subsidy d. public housing e. public supplement

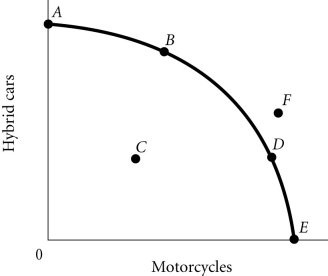

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, as the economy moves from Point D to Point B, the opportunity cost of hybrid cars, measured in terms of motorcycles,

Figure 2.4According to Figure 2.4, as the economy moves from Point D to Point B, the opportunity cost of hybrid cars, measured in terms of motorcycles,

A. initially increases, then decreases. B. increases. C. remains constant. D. decreases.