Which of the following is a characteristic of a more efficient tax system?

a. The system minimizes deadweight loss.

b. The system raises the same amount of revenue at a lower cost.

c. The system minimizes administrative burdens.

d. All of the above are correct.

d

You might also like to view...

What important changes have occurred in the composition of the labor force since 1960? Is the popular image of the American worker as a factory worker accurate? Describe the types of jobs Americans are working in today.

What will be an ideal response?

A simultaneous increase in both the demand for MP3 players and the supply of MP3 players would imply that

a. both the value of MP3 players to consumers and the cost of producing MP3 players has increased. b. both the value of MP3 players to consumers and the cost of producing MP3 players has decreased. c. the value of MP3 players to consumers has decreased, and the cost of producing MP3 players has increased. d. the value of MP3 players to consumers has increased, and the cost of producing MP3 players has decreased.

Today, the average U.S. tariff is 1.6 percent of the value of imported goods, which is very low by historical standards.

Answer the following statement true (T) or false (F)

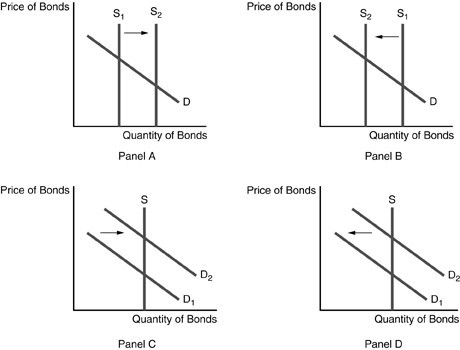

Refer to the above figure. Which panels could represent the situation if the Fed had engaged in open market operations?

Refer to the above figure. Which panels could represent the situation if the Fed had engaged in open market operations?

A. Panels A and B B. Panels A and C C. Panels B and C D. Panels C and D