An investor with a short position in Treasury notes futures will profit if

A. interest rates decline.

B. interest rates increase.

C. the prices of Treasury notes increase.

D. the price of the long bond increases.

E. None of the options are correct.

B. interest rates increase.

Profit to long position = spot price at maturity original futures price.

You might also like to view...

Which of the following would be the likely risk results from using a 1% level of detection risk?

a. High detection risk and low audit risk. b. High detection risk and high audit risk. c. Low detection risk and high audit risk. d. Low detection risk and low audit risk.

How would accepting the order affect Grill Time's operating income?

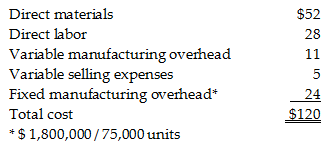

Grill Time sells its barbecue sets for $170 each. Suppose the company incurs the following average cost per barbecue set:

Grill Time has enough idle capacity to accept a one-time-only special order from Backyard Living, Inc. for 2,000 barbecue sets at a sales price of $130 per set. Grill Time will not incur $2 of variable selling expenses for this order.

According to the categorization of multinational organizations, configuration of assets and capabilities in an international organization are ______.

A. decentralized and nationally self-sufficient B. centralized and globally scaled C. sources of core competencies centralized, others decentralized D. dispersed, interdependent, and specialized

Which is NOT a characteristic of a limited liability partnership?

A) One or more of the partners must be a general partner to whom the privilege of limited liability does not apply. B) Prohibits the limited partners from participating in the management of the partnership. C) Partners pay taxes on dividends distributed. D) One or more partners have limited liability.